Introduction

Are you searching for a reliable and efficient way to send money to the Philippines? Whether you’re supporting your family back home, investing in businesses, or simply fulfilling financial obligations, finding the right remittance method is crucial through the essential factors to consider When sending money to the Philippines, ensuring a smooth and hassle-free transfer process. We’ve got you covered from exchange rates and fees to transfer methods and security.

Factors to Consider When Sending Money to the Philippines:

Exchange Rates: Maximizing Your Transfer Value

Exchange rates can significantly impact the amount your recipient receives in the Philippines. Keep a close eye on exchange rates and choose a remittance option that offers competitive rates to ensure your money goes further. Find the exchange rate for the day on the exchange rate information provider.

Remittance Fees: Finding Affordable Options

Remittance fees can vary across different providers. Compare the fees charged by banks, online money transfer services, and remittance companies. Look for providers that offer transparent and affordable fees, and consider any waived or discounted promotions available.

Some of the fees for service providers.

Western Union in Japan remittance fee – Starting from 390 Yen to send 10,000 Yen. WorldRemit remittance fee – Starting from 200 Yen to send 10,000 Yen.

Seven Bank remittance fee – Starting from 990 Yen to send 10,000 Yen. Maximum fees are In the range of 2000 Yen depending on speed and location.

Transfer Methods: Choosing the Right Option for You

Explore the various transfer methods available for sending money to the Philippines. Traditional bank transfers are often convenient, but online money transfer services and remittance companies can offer faster and more accessible options.

Transfer Speed: Balancing Convenience and Urgency

Consider how quickly you need the funds to reach your recipient. Some remittance services provide instant transfers, while others may take a few business days. Choose a transfer speed that aligns with your urgency and convenience requirements.

Security and Reliability: Protecting Your Funds

Ensure the remittance provider you choose prioritizes security and has a track record of reliable transfers. Look for established and trusted companies that have implemented robust security measures to protect your financial information and ensure safe transactions.

Transfer Limits: Staying Within Permissible Boundaries

Check if there are any limits on the amount of money that can be sent to the Philippines. Familiarize yourself with the maximum limits per transaction or per day imposed by the remittance provider or regulatory authorities to avoid any issues.

Local Payout Options: Ensuring Accessibility for Recipients

Consider the available payout options for your recipient in the Philippines. Common methods include bank deposits, cash pickup at designated locations, or mobile wallet transfers.

Regulatory Compliance: Following Legal Guidelines

Ensure that the remittance provider you choose operates in compliance with the regulations set by the authorities in both Japan and the Philippines.

Popular Remittance Options for Sending Money to the Philippines:

Bank Transfers: Traditional and Convenient

Bank transfers are a common and convenient way to send money to the Philippines. Visit your local bank branch or use online banking services to initiate the transfer. However, keep in mind that bank transfers may not always offer the most competitive exchange rates or fastest transfer speeds.

Online Money Transfer Services: Speed and Accessibility

Online money transfer services provide a quick and accessible way to send money to the Philippines. Companies like TransferWise, Remitly, or WorldRemit allow you to initiate transfers online or through mobile apps, offering competitive exchange rates and transparent fees.

Remittance Companies: Specialized Solutions

Remittance companies focus specifically on international money transfers. Western Union and MoneyGram are popular options that provide extensive networks for cash pickups in the Philippines.

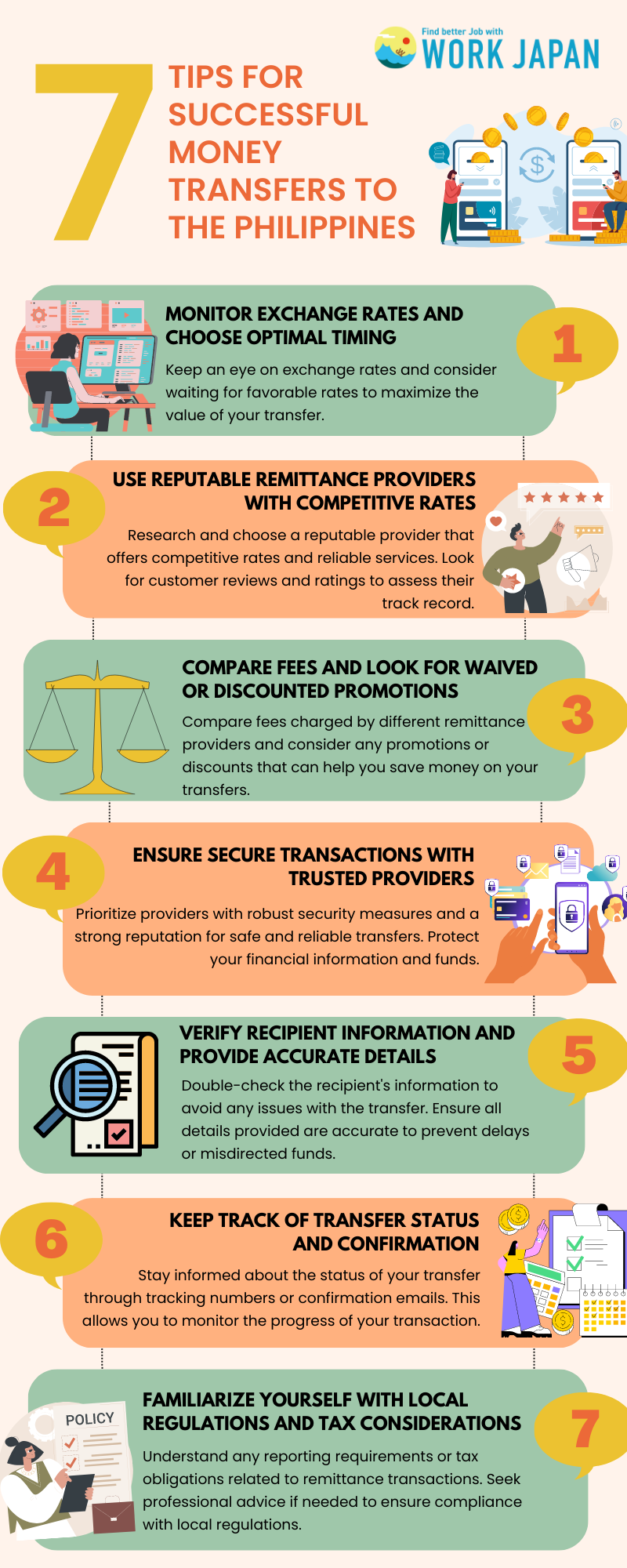

Tips for Successful Money Transfers to the Philippines:

Monitor Exchange Rates and Choose Optimal Timing: Keep an eye on exchange rates and consider waiting for favourable rates to maximize the value of your transfer.

Use Reputable Remittance Providers with Competitive Rates: Research and choose a reputable provider that offers competitive rates and reliable services. Look for customer reviews and ratings to assess their track record.

Compare Fees and Look for Waived or Discounted Promotions: Compare fees charged by different remittance providers and consider any promotions or discounts that can help you save money on your transfers.

Ensure Secure Transactions with Trusted Providers: Prioritize providers with robust security measures and a strong reputation for safe and reliable transfers. Protect your financial information and funds.

Verify Recipient Information and Provide Accurate Details: Double-check the recipient’s information to avoid any issues with the transfer. Ensure all details provided are accurate to prevent delays or misdirected funds.

Keep Track of Transfer Status and Confirmation: Stay informed about the status of your transfer through tracking numbers or confirmation emails.

Familiarize Yourself with Local Regulations and Tax Considerations: Understand any reporting requirements or tax obligations related to remittance transactions. Seek professional advice if needed to ensure compliance with local regulations.

Conclusion:

Sending money to the Philippines doesn’t have to be a daunting task. By considering factors such as exchange rates, remittance fees, transfer methods, security, and transfer limits, you can make informed decisions that maximize the value of your transfers. monitor exchange rates and stay informed about local regulations to ensure secure and convenient transactions. With the right approach, you can confidently send money to the Philippines, providing vital support to your loved ones or fulfilling your financial obligations with ease.